irs child tax credit 2021

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The IRS pre-paid half the total credit amount in monthly payments from.

Child Tax Credit 2021 Changes Grass Roots Taxes

The credit amounts will increase for many.

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. For 2021 the credit amount is. E-File Your Tax Filing for Free.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. 2021 Child Tax Credit Calculator. The deadline to e-file 2021 Tax Returns was October 17 2022.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

This credit is only available for children under age 6. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. However in 2012 the IRS stopped issuing this chart. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers.

2022 when the tax agency will begin accepting and processing. For 2021 eligible parents or guardians. Have been a US.

Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit CHILDCTC as monthly payments of 300 per child under age 6 and 250 per child between. IRS to Release Refund by March 1 2022.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. Ad Home of the Free Federal Tax Return. Use these 2021 Tax Calculators and Forms to help you prepare your 2021 Taxes before you.

Child Tax Credit Update. A childs age determines the amount. Ad Home of the Free Federal Tax Return.

E-File Directly to the IRS. The taxpayer had not included the payment in income following Notice 2014-7 but did include the amount as earned income in computing an earned income credit under IRC. E-File Directly to the IRS.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

2021 Advanced Child Tax Credit What It Means For Your Family

2021 Child Tax Credit Advanced Payment Option Tas

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

How The New Expanded Federal Child Tax Credit Will Work

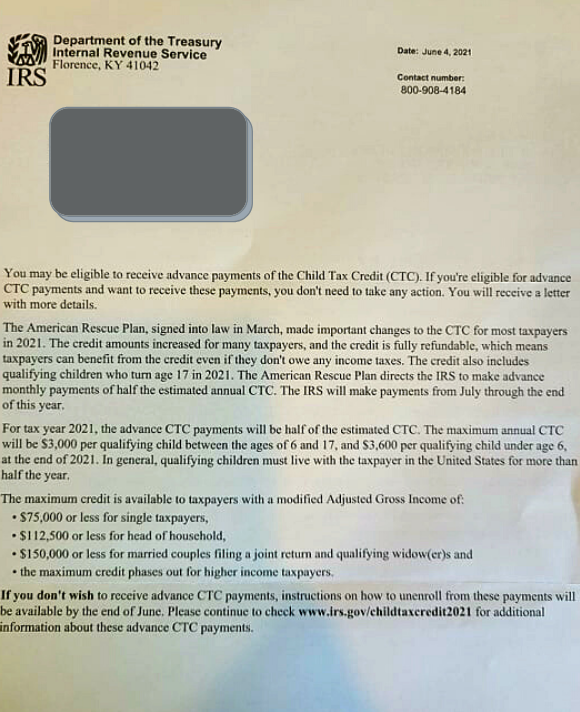

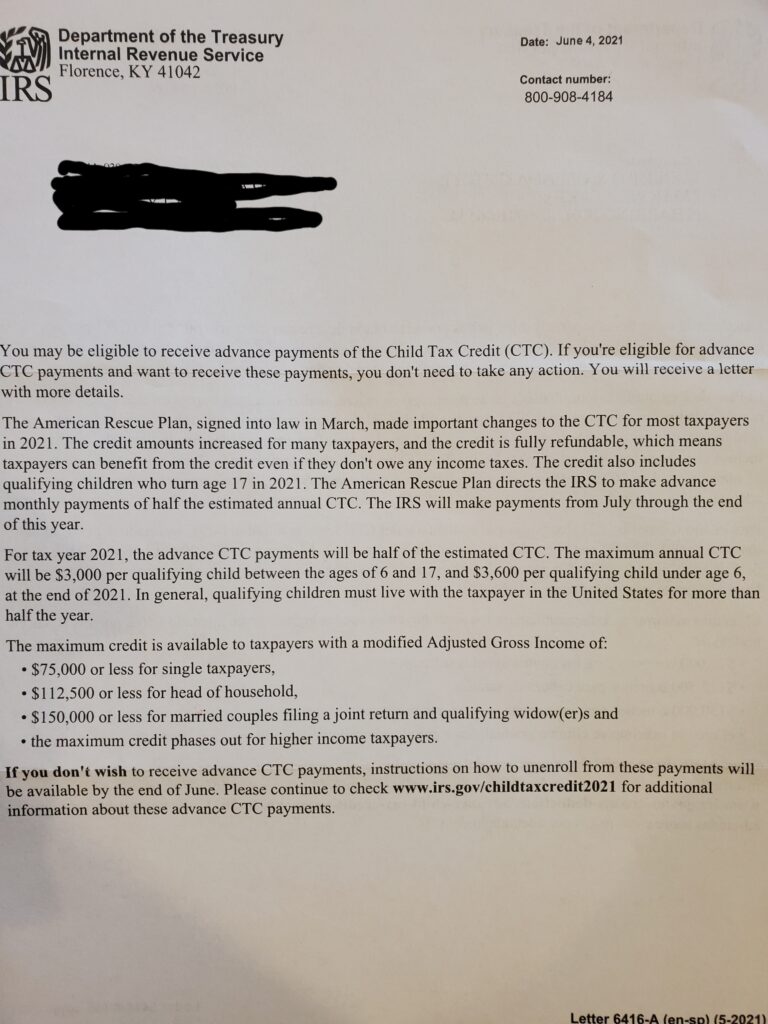

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

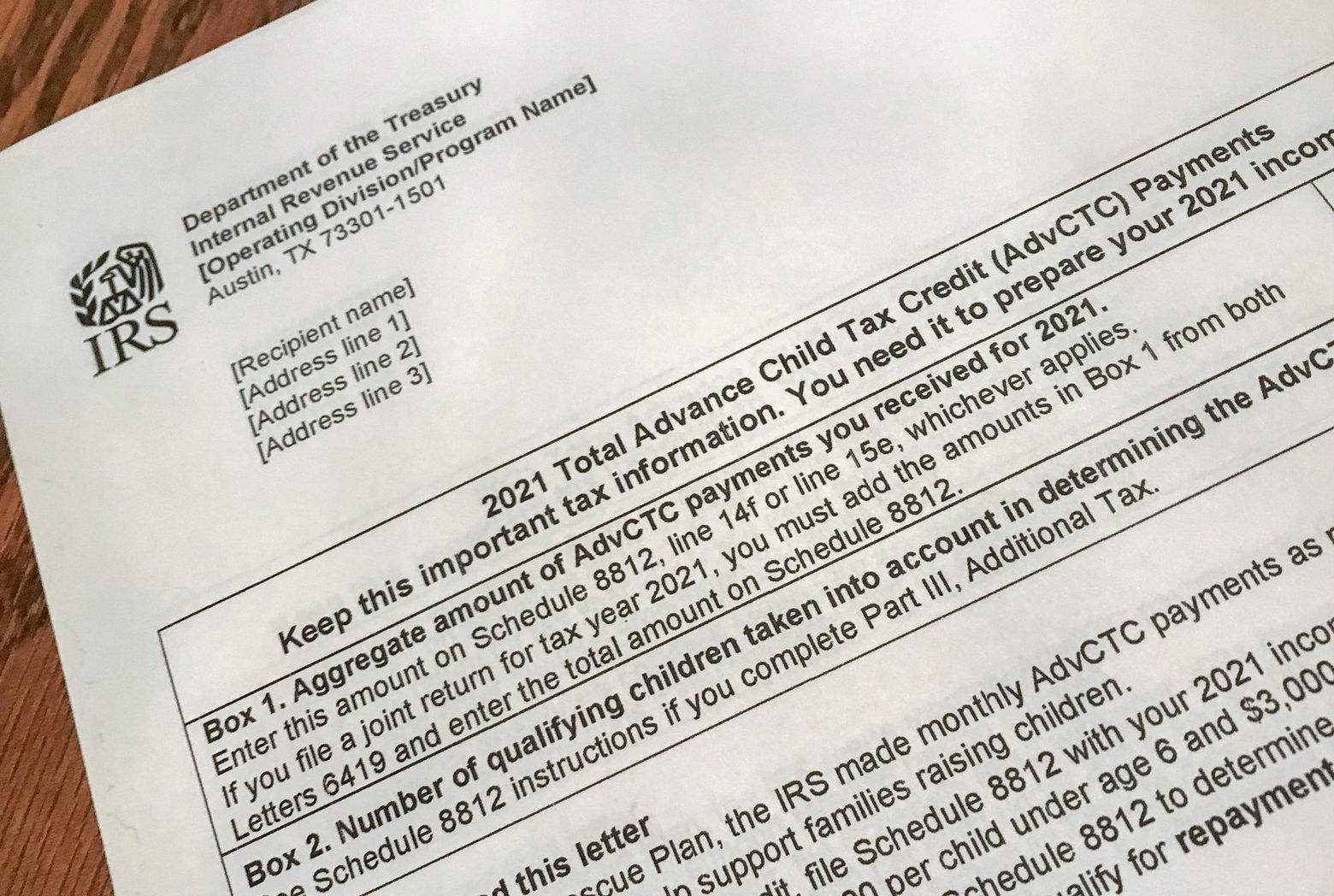

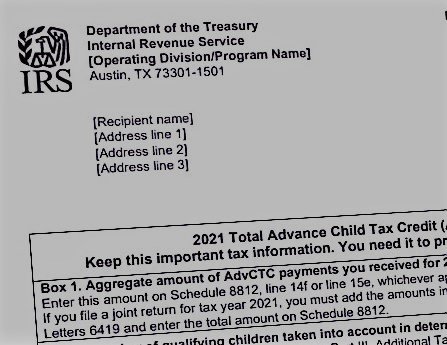

Wtform Child Tax Credit Letter 6419 Explained Youtube

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kabb

2021 Child Tax Credit Payments Does Your Family Qualify

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Child Tax Credits Causing Confusion As Filing Season Begins

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

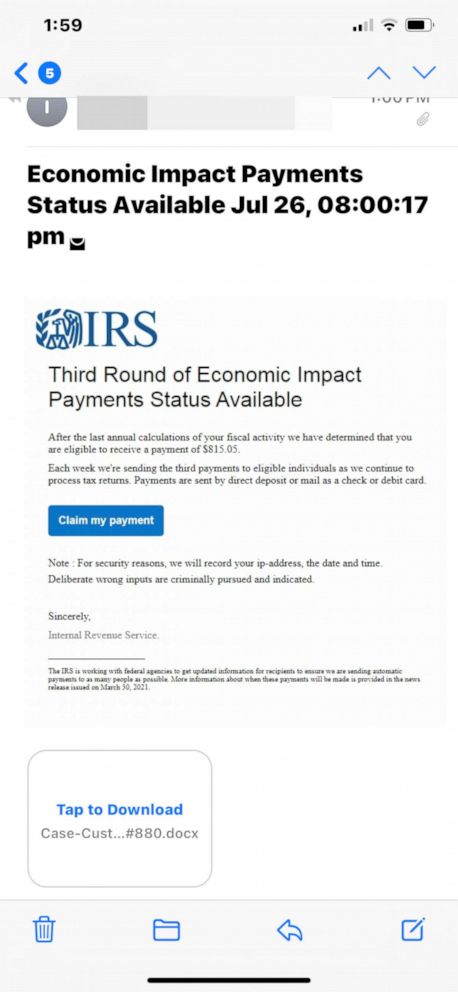

Irs Warns Of Child Tax Credit Scams Abc News

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out