puerto rico tax incentives act 22

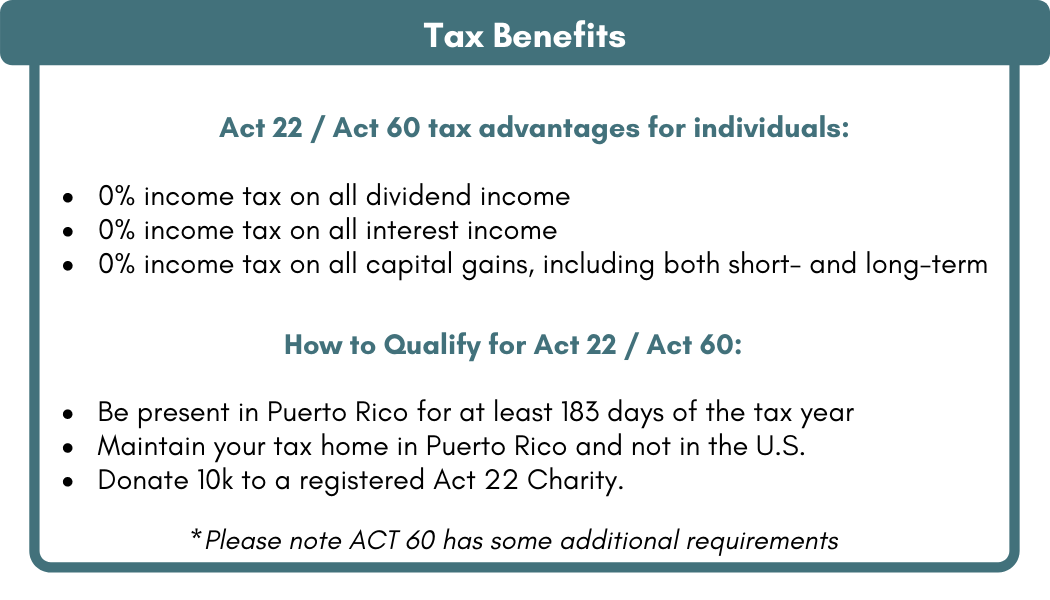

Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors Act. In addition to Act 20 Puerto Rico also passed Act 22 known as the Individual Investors Act so as to attract wealthy individual investors to relocate to the Island.

Ddec Supports Acts 20 22 Business Theweeklyjournal Com

22 of 2012 as amended known as the Individual Investors Act the Act.

. Act 60 Former Acts 2022 In January of 2012 the Government of Puerto Rico signed into law both Act 20 and 22 providing aggressive incentives to urge investors to move to the Island to. The new law does NOT eliminate the existing. Puerto Rico Tax Incentives.

The most famous are Act 20 and Act 22now the Export Services and the Individual Resident Investor tax incentives respectively under the newly enacted Act 60but. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent. The 2022 Act Society is a non-profit organization created to foster a sense of community among those moving to Puerto Rico to take advantage of Acts.

Changes to Act 2022 New. In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code. Many high-net worth Taxpayers are understandably upset about the massive US.

The Purpose of the 2022 Act Society. In Puerto Rico with local or non-local capital to export services at a preferential tax rate among other benefits. Of particular interest are Chapter 2 of Act 60 for.

The Act may have profound implications for the. Act 20 and Act 22 were enacted in Puerto Rico in 2012 to promote the exportation of services by companies and individuals providing such services from Puerto Rico and the. 22 -2012 also known as The Individual Investors Act and its subsequent amendment seek to attract new residents to Puerto Rico by providing an exemption on certain investment.

On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. The New Incentives Code allows for the companys operation and service. Get to know about Puerto Rico Tax Act 20 and Tax Act 22 to minimize your tax liability.

As financial experts we guide you through the process of Act 20 and 22 Tax benefits. In January of 2012 Puerto Rico passed legislation making it a tax haven for US. In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or Economic Incentives Act went into effect.

Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020. Citizens that become residents of Puerto Rico. Puerto Rico Incentives Code 60 for prior Acts 2020.

Puerto Rico US Tax. On January 17 2012 Puerto Rico enacted Act No. Citizens that become residents of Puerto Rico.

The government of Puerto Rico enacted in 2012 Act 22 known as An Act to Promote the Relocation of Individual Investors to prime up the economic development of. Taxes levied on their. Then under a law referred to as Act 60 formerly Act 20 and Act 22 Puerto Rico has enacted several tax incentives the two most popular of which are as follows.

27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico Act 22 now Act 60. Also during the year 2012 two additional laws.

Act 20 22 Act 73 Puerto Rico Puerto Rico Vieques Luxury Property For Sale

Puerto Rico 39 S Act 20 And Act 22 Key Tax Benefits Insights Dla Piper Global Law Firm Law Firm Puerto Rico Insight

The Impacts Of Puerto Rico S Act 20 And Act 22

The Impacts Of Puerto Rico S Act 20 And Act 22

Puerto Rico S Act 20 And Act 22 Residents And Hurricane Maria Premier Offshore Company Services

Ddec Supports Acts 20 22 Business Theweeklyjournal Com

Puerto Rico Pursues Long Sought Overhaul Of Tangled Tax System

Develop More Entrepreneurs Through Your Act 60 Benefits Friends Of Puerto Rico

List Of All Puerto Rico Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Omnia Economic Solutions Solutions Fictional Characters Character

Pr S Status As A Tax Haven Is Beginning To Catch On

Could Moving To Puerto Rico Reduce Your Taxes Expensivity

The Impacts Of Puerto Rico S Act 20 And Act 22

Tumblr Puerto Rico Sotheby S Realty Sotheby Realty Luxury Real Estate Caribbean Travel

Why People Are Moving To Puerto Rico In 2018 Act 20 Act 22 Youtube Puerto Rico Why People Acting

Why People Are Moving To Puerto Rico In 2018 Act 20 Act 22 Youtube Puerto Rico Why People Acting

![]()

Puerto Rico S Aggressive Tax Incentives Talented Local Crews Varied Backdrops Solid Infrastructure And Sound Legal Protections Puerto Puerto Rico Incentive

The Next 10 Years Will Be About Market Networks Networking Marketing 10 Years